In November 2015 the government spending review announced a five point housing plan to support low-cost home ownership for first-time buyers. The increase in stamp duty for additional residential property purchases is intended to reduce the amount of buy-to-let landlords in the lower end of the property market, thus freeing up low-cost properties for first time buyers.

Stamp duty land tax (SDLT) is a mandatory tax paid when buying a freehold or leasehold property in England, Wales and Northern Ireland.

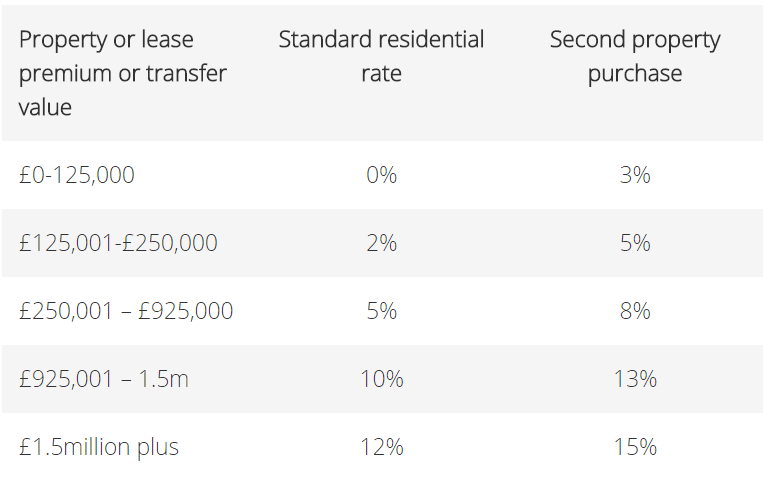

Second property purchase rates have been inflated by 3% across the board which is shown in the table below:

Stamp duty for a traditional residential property purchases has not changed, for example a first time buyer or those who are purchasing a new primary home will not be subject to the increased rates.

Stamp duty is payable on residential property over £125,000 and £150,000 for non-residential land and property. HMRC have created this online calculator to help determine how much stamp duty is required dependent on the value of the property.

Visit https://www.gov.uk/stamp-duty-land-tax/overview for a simple overview and more information on Stamp Duty.